Summary of changes

Version 3.1.2 from 11.05.2021

This section reflects the changes in the document made from 01/01/2021.

| Version number | Section | Description | Date of change |

|---|---|---|---|

| 3.1.1 | API Payout by a Cryptogram | Added the Payer parameter to the method for payment by cryptogram of payment data | 2021-01-18 |

| 3.1.2 | API Payout by a Cryptogram | Including limits to the test terminals | 2021-05-11 |

General

Terms and Definitions

- System — CloudPayments’ payment gateway.

- Merchant — CloudPayments’ client who works with the System.

- API — application program interface for interacting with the system, located at https://api.cloudpayments.ru

- Back Office — merchant's back office in the system, located at https://merchant.cloudpayments.ru

- Card — a bank card of Visa, MasterCard or MIR systems.

- Acquirer — a settlement bank.

- Issuer — a bank that issued a card.

- Cardholder — an owner of a card issued by a bank.

- Widget — payment form, provided by the system to enter card data by a holder and perform a further authorization.

- 3-D Secure — protocol to verify a holder by the issuer.

Transaction Types

The system involves two types of operations: payment and refund. In the first case, money is transferred from holder's account to the merchant, in the second - vice versa. A merchant performs a refund if a buyer wants to return goods, and it is always associated with a payment transaction, which amount returns to a holder. It is possible to refund a whole payment amount or it's part only. Money usually comes back to a holder’s card the same day, but sometimes (it depends on an issuer) it can take up to 3 days. The payment operation, unlike the refund, can be cancelled. Payment can be canceled by a merchant if the payment has been made with an error: incorrect amount, technical failure on the merchant's side, etc. There is a limitation - operation can be cancelled only if a merchant using the two-stage payment scheme. Money at the same time will be available on the card almost immediately.

Payment Schemes

There are two options to make a payment transaction: single message system (SMS) and dual message system (DMS).

Single message payment is made by a single command, depending on the authorization results money is transferred to a merchant.

Dual message payment uses 2 commands: one is used for authorization and another — for a withdraw. After a successful authorization, transaction amount is going to be locked on a cardholder’s account and become unusable for other payments. Then merchant has up to 7 days (depending on a card type) to confirm a transaction to make a withdraw. If a transaction hasn't been confirmed during this time interval, it becomes cancelled automatically. It is possible to confirm full amount or it's part only.

As a rule, the dual message scheme is used to obtain a deposit from a payer, for example, in rental companies or hotels.

Depending on a configuration, the system can automatically confirm dual message payments within a specified number of days.

Payment Methods

A payment can be made using following methods:

Via payment form — widget. Add a script that opens a secure payment form (iframe) to enter card data.

Via API by a card’s cryptogram. Add a checkout to your web site which collects card data from any web site’s form, encrypts and creates a cryptogram for a secured transmission through an interserver interaction.

Via Apple Pay and Google Pay on Web and in Mobile.

Via SDK for mobile applications. Integrate our mobile SDK's into your application for iOS or Android and accept card payments from phones or tablets of your buyers.

Via API by a card’s token (recurring). Once the first payment via a widget or by cryptogram is made/authorized, the system assigns an identifier to card data. Such ID is a token which can be safely stored and used for non-acceptance payments (pay per click). The token is returned in a Pay notification and in a system reply to a API request.

Using a configured plan of periodic payments (recurrent). Once the first payment is done/authorized, the system assigns a token to card data, which is then used to create a subscription plan for recurrent payments. A payment is made automatically by the system, without any payer’s confirmation, according to a customized time period which can be once a day (once some days), once a week (once some weeks) or once a month (once some months). If a next payment attempt fails, the system sends a notification and reattempts in a day. After 3 unsuccessful attempts the system cancels a subscription. During the plan creation, it is possible to specify maximum number of periods, for example, 12 months with a monthly payment, then a subscription will be automatically completed.

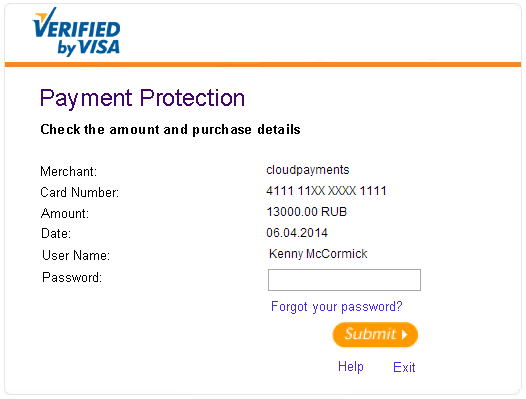

3-D Secure

3-D Secure is a common name of Verified By Visa and MasterCard Secure Code programs from Visa and MasterCard's respectively. In general, such program shall authenticate a cardholder (that is to protect against an unauthorized card usage) by an issuer before a payment. Actually, it looks as follows: a cardholder specifies card data. Then the issuer’s web site opens, where a cardholder has to enter a password or a secret code (usually, the code is sent in a SMS message). If the code is correct, a payment will be successful. Otherwise, it will be rejected.

During the payment process, 3-D Secure appears not on all cards, but only on those, Issuers supporting this technology. Certainly, payments without 3-D Secure are a less secure option.

Payment Widget

Payment widget is a pop-up form to enter card data and payer’s email address. The widget automatically defines a payment system type: Visa, MasterCard, Maestro or MIR, and an emitting bank of a card and corresponding logos. The form is optimized for use in any browsers and mobile devices. There is an iframe opens within a widget which guarantees a security of card data sending and does not require a certification for merchant's usage.

Widget Installation

To install a widget, you need to add a script on a web site to the head section:

<script src="https://widget.cloudpayments.ru/bundles/cloudpayments"></script>

Define a function for charge or auth methods calling for payment form to display:

this.pay = function () {

var widget = new cp.CloudPayments();

widget.pay('auth', // or 'charge'

{ //options

publicId: 'test_api_00000000000000000000001', //id of site (from back office)

description: 'Payment example (no real withdrawal)', // purpose/justification/description

amount: 10,

currency: 'RUB',

accountId: 'user@example.com', //customer's/user's/payer's ID (optional)

invoiceId: '1234567', // order number (optional)

skin: "mini", // disign widget (optional)

data: {

myProp: 'myProp value' //arbitrary set of parameters

}

},

{

onSuccess: function (options) { // success

//action upon successful payment

},

onFail: function (reason, options) { // fail

//action upon unsuccessful payment

},

onComplete: function (paymentResult, options) { //It is called as soon as the widget receives a response from api.cloudpayments with the result of the transaction.

//e.x. calling your Facebook Pixel analytics

}

}

)

};

Call the function when some event is emitted, for example click on the «Pay» button:

$('#checkout').click(pay);

The demonstration of the widget is presented in our demo store. For testing you can use both test card data and real ones. Money withdrawal will not occur.

Parameters

A call of charge or auth function defines a payment scheme:

- charge for single,

- auth — for dual.

| Parameter | Type | Use | Description |

|---|---|---|---|

| publicId | String | Required | A web site identifier; located in Back Office |

| description | String | Required | Description of a payment purpose in any format |

| amount | Float | Required | Payment amount |

| currency | String | Required | Currency: RUB/USD/EUR/GBP (see the reference) |

| accountId | String | Required for creation of subscription | Payer's ID (endpoint customer) |

| invoiceId | String | Optional | Order or Invoice number |

| String | Optional | E-mail of that user | |

| requireEmail | bool | Optional | Require user's email address to be specified in the widget |

| data | Json | Optional | Any other data which relates to a transaction, including instructions for a subscription creation or generation of an online receipt. We reserved names of following parameters and display their contents in a transaction registry which are available in the Back Office: name, firstName, middleName, lastName, nick, phone, address, comment, birthDate. |

| skin | String | Optional | Widget design option. Possible values: "classic", "modern", "mini". The classic is default |

| retryPayment | bool | Optional | Display the "Repeat payment" button if the payment is unsuccessful. (true is default) |

You can define the form behaviour for successful or unsuccessful payment using the following parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| onSuccess | Function or String | Optional | Either a function or a web site's page is specified. If a function is specified, it will be called after successful payment completion. If a page is specified, a payer will be directed to a specified page |

| onFail | Function or String | Optional | Either a function or a web site's page is specified. If a function is specified, it will be called after unsuccessful payment completion. If a page is specified , a payer will be directed to a specified page. |

| onComplete | Function | Optional | A function is specified that will be called as soon as the widget receives a response with the result of the transaction. You cannot make redirects in this method. |

Widget Localization

The widget is in Russian by default. You need to add the language parameter in the widget to localize it:

var widget = new cp.CloudPayments({language: "en-US"});

List of supported languages:

| languages | Timezone | Value |

|---|---|---|

| Russian | MSK | ru-RU |

| English | CET | en-US |

| German | CET | de-DE |

| Latvian | CET | lv |

| Azerbaijani | AZT | az |

| Russian | ALMT | kk |

| Kazakh | ALMT | kk-KZ |

| Ukrainian | EET | uk |

| Polish | CET | pl |

| Portuguese | CET | pt |

| Czech | CET | cs-CZ |

| Vietnamese | ICT | vi-VN |

| Turkish | TRT | tr-TR |

| Spanish | CET | es-ES |

| Italian | CET | it |

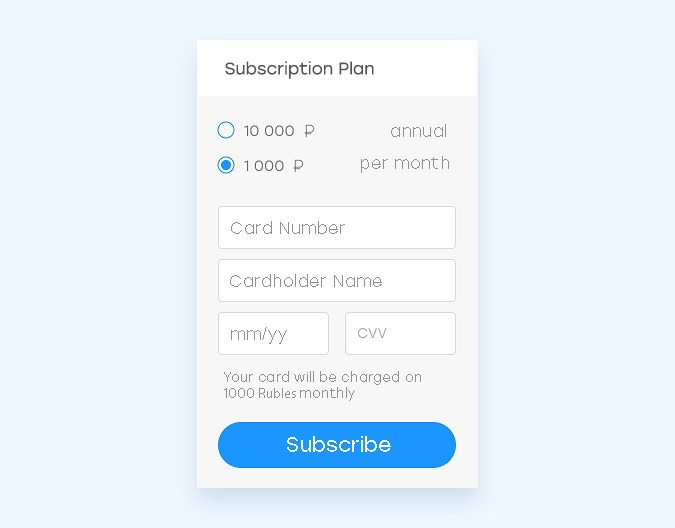

Recurrent Payments (Subscription)

After successful payment the widget can automatically create a subscription to recurrent payments. For that you have to add the next parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Interval | String | Required | An interval. Possible values are: Day, Week, Month. |

| Period | Int | Required | A period. Use in combination with an interval, 1 Month means once a month, and 2 Week means biweekly. |

| MaxPeriods | Int | Optional | Maximum number of payments in a subscription. No limitation by default |

| Amount | Numeric | Optional | A regular payment amount. Matches with the first payment amount by default. |

| StartDate | DateTime | Optional | Date and time of the first regular payment. By default a startup will occur in a specified interval and the period, for example, in a month. |

| CustomerReceipt | String | Optional | Data for generation of an online receipt. |

It is necessary to add the parameters for starting regular payments to the data.cloudPayments.recurrent as shown below:

this.pay = function () {

var widget = new cp.CloudPayments();

var receipt = {

Items: [//positions of goods

{

label: 'Product #2', //goods name

price: 300.00, //price (per 1 item)

quantity: 3.00, //quantity

amount: 900.00, // line amount (incl. the discounts)

vat: 20, // vat rate

method: 0, // tag-1214 sign of a calculation method

object: 0, // tag-1212 sign of the subject of calculation - sign of items, goods, services, payment, payout or other subject of calculation

}

],

taxationSystem: 0,

email: 'user@example.com', //e-mail of customer, if you need to send an online-receipt

phone: '', //phone of customer, if you need to send an online-receipt in SMS as link

isBso: false, // receipt hasn't a strict reporting form

amounts:

{

electronic: 900.00, // The amount of payment by electronic money (2 decimal places)

advancePayment: 0.00, // Amount from prepayment (offset of advance payment) (2 decimal places)

credit: 0.00, // Amount of prepayment (on credit) (2 decimal places)

provision: 0.00 // The amount of payment by the reciprocal grant (certificates, other material values) (2 decimal places)

}

};

var data = {};

data.cloudPayments = {

CustomerReceipt: receipt, //receipt for the first payment

recurrent: {

interval: 'Month',

period: 1,

customerReceipt: receipt //receipt for recurring payments

}

}; //create a monthly subscription

widget.charge({ // options

publicId: 'test_api_00000000000000000000001', //id of site (from back office)

description: 'Subscription on monthly access to https://example.com', //justification

amount: 1000, //subscription amount

currency: 'RUB',

invoiceId: '1234567', //order or invoice number (optional)

accountId: 'user@example.com', //customer/user's ID (required for subscription)

data: data

},

function (options) { // success

//action upon successful payment

},

function (reason, options) { // fail

//action upon unsuccessful payment

});

};

For more examples of accepting payments using the widget see Integration Scenarios.

For cancelling of recurrent payments use BackOffice features, API, or provide a customer with a link to the system web site https://my.cloudpayments.ru/unsubscribe where he or she can find and cancel subscriptions by him or herself.

Widget Mobile

A script automatically defines user device and starts the most suitable widget option: customary mode or optimized for mobile devices . For customers's convinience the mobile version occupies a whole screen and prompts to make a payment using a card, or Apple Pay, or Google Pay.

- The widget offers Apple Pay on iPhone and iPad in the Safari browser;

- A customer confirms payment using Face ID or Touch ID;

A payment is instantly and successfully completed;

The widget offers Google Pay on Android devices in the Chrome browser;

Depending on device features customer confirms payment by biometry, password, or 3-d Secure;

Payment is instantly and successfully completed.

You can make payments in the widget via Apple Pay and Google Pay if following conditions are met:

- A web site works through HTTPS and supports TLS version 1.2.

- A web site provides no "mixed content", when a part of resources is loaded through HTTPS, and another part is through HTTP.

- Simplified (only for websites) or classic integration of Apple Pay functions.

- The customer opened the payment page on the site in a browser that supports Apple or Google Pay. For Apple Pay, this is Apple Safari, for Google Pay - Google Chrome, Mozilla Firefox, Apple Safari, Microsoft Edge, Opera, or UCWeb UC. Other browsers do not support Apple or Google Pay payments.

Checkout Script

Checkout is a script which may be built into your website. It collects card data from a specified form needed for cryptogram generation in order to make payment via API available.

The cryptogram is generated according to the RSA algorithm with a key length of 2048 bit and meets the standard on the card data protection. You do not receive card data following the next requirements, but your server can still influence card data security.

Requirements

Form requirements:

- It must be loaded through HTTPS connection with a valid SSL certificate;

- Fields must not contain the “name” attribute. It prevents card data from passing to a server when sending a form;

- A card number field must be filled in the range from 16 to 19 digits.

Cryptogram requirements:

- It must be generated only by the original checkout script loaded from the system addresses.

- It is prohibited to store a cryptogram after payment and reuse it.

PCI DSS security requirements:

In terms of PCI DSS a such way is classified as follows: “E-commerce merchants who outsource all payment processing to PCI DSS validated third parties, and who have a website(s) that doesn’t directly receive cardholder data but that can impact the security of the payment transaction. No electronic storage, processing, or transmission of any cardholder data on the merchant’s systems or premises.” That means payment data is processed by a third party, but a web site influences a security of card data.

You have to fill the SAQ-EP self-estimation sheet and quarterly pass the ASV test to meet the standard requirements.

For more information on compliance with PCI requirements see PCI DSS.

Installation

To create a cryptogram, you need to add checkout script on a page with a payment form:

<script src="https://widget.cloudpayments.ru/bundles/checkout"></script>

At the beginning create a card data entering form:

<form id="paymentFormSample" autocomplete="off">

<input type="text" data-cp="cardNumber">

<input type="text" data-cp="expDateMonth">

<input type="text" data-cp="expDateYear">

<input type="text" data-cp="cvv">

<input type="text" data-cp="name">

<button type="submit">Pay 100 Rubles</button>

</form>

Input fields must be marked with the following attributes:

- data-cp="cardNumber" — a field with a card number;

- data-cp="expDateMonth" — a field with an expiration month;

- data-cp="expDateYear" — a field with an expiration year;

- data-cp="cvv" — a field with a CVV code;

- data-cp="name" — a field with the last name and the first name of a cardholder.

Once done add a script to create a cryptogram:

this.createCryptogram = function () {

var result = checkout.createCryptogramPacket();

if (result.success) {

// if cryptogram generated successfully

alert(result.packet);

}

else {

// if issues found, object `result.messages` returns:

// { name: "Name field contains too much letters", cardNumber: "Wrong PAN" }

// where `name`, `cardNumber` matches to attribute values `<input ... data-cp="cardNumber">`

for (var msgName in result.messages) {

alert(result.messages[msgName]);

}

}

};

$(function () {

/* Creation of checkout */

checkout = new cp.Checkout(

// public id

"test_api_00000000000000000000001",

// tag, containing card data fields

document.getElementById("paymentFormSample"));

});

Then send the cryptogram and a name of a card holder to a server and call a payment method via API.

You may learn how Checkout script works in our demo store . You can use both test card data and real one for testing. Money withdrawal will not occur.

When developing your own form, pay attention to the following points:

- A card number length is from 16 to 19 digits;

- Checkout script is not compatible with out-of-date and unsafe browsers which do not support TLS encryption protocols version 1.1 or higher. For example, Internet Explorer 7;

- 3DS window can be displayed either in a new window or in a frame over a page. A window size should be at least 500×500 pixels.

Recurrent Payments

Recurrent payments that are also known as payments by subscription provide an ability to perform regular money withdrawal from a payer's bank card without re-entering of card details and without participation of a payer for initiation the next payment.

Recurrent payments always begin with the first (setup) payment which requires a payer's card details. It is necessarily needed to familiarize a card holder with the schedule and obtain his consent of direct withdrawal for later regular payments.

There is a widespread belief that the task of recurrent payments is to set an amount to be withdrawn from a client’s card each month. Choice of a regular payment system is based only on cost of provided services. Actually the situation is more complicated because quality of service requires far more functions and features and therefore the procedure for launching and processing recurrent payments in CloudPayments is as simple and flexible as possible while in other systems it is more complicated and limited.

Starting and Stopping Subscriptions

You can start recurrent payments at any time once a setup payment is effected: at the same time, in a week, or in a month. There is the only one restriction: the interval between regular payments, as well as between the starting and the first regular payment, can not exceed one year.

Example: A customer pays the first month of services provision for the first time and consents to a monthly withdrawal from his card starting from the second month. Regular payments can be scheduled through API or payment widget.

If a customer refuses further payments, you can cancel a subscription at any time:

- Via Back Office;

- Via API.

Also a customer can independently find and cancel his or her regular payments at CloudPayments site.

Customizing Payment Schedule

Withdrawal Period and Interval Selection

The system can effect regular payments every 2 weeks, 1 time per month, every 3 months, and so on: you can specify any period.

Withdrawal Starting Date Selection

Recurrent payments can be started immediately when you create a subscription, or with a delay.

Example: A customer subscribes to your service in the middle of a month, then you create a plan for monthly recurring payments starting from the next month on the 15th each month.

Payment Limit

You can specify maximum number of payments in a subscription, or you can create a plan without any limits. In the first case, recurrent payments will be automatically stopped once all the payments in the schedule are done.

Example: A customer purchases goods worth 600$ in installments for a year. He or she pays 50$ as a setup payment and subscribes to a recurrent payment plan of 50$ monthly, but no more than 11 withdrawals.

Subscription Plan Freezing

Subscription to regular payments can be suspended at any time from your personal account or via API.

Example: A customer asks to suspend services provision for a couple of months, then you shift a date of the next payment for the corresponding period.

Payment Amount Change

Setup Payment Amount

Amount of the first (setup) payment can be arbitrary and differ from amount of subsequent recurrent payments.

Example: A customer signs up in your service, then you ask him or her to make a setup payment for 1 ruble (or 1 of another currency) to check the card. After that you can start recurrent payments for any amount with the consent of a customer.

Recurrent Payments Amount Change

Amount of recurrent payments can be changed at any time during the term of a plan through Back Office or via API.

Example: You grant a discount to a customer for the first two months of using the service, then you can increase subscription amount.

Automatic error correction

Errors that occur when making recurrent payments can be separated into two categories: recoverable and non-recoverable.

The first category includes errors associated with insufficient funds on a customer's card, errors of temporary technical problems, or unavailability of a card issuing bank. As a rule, these problems are recoverable over time or by the intervention of a cardholder.

Errors that cannot be corrected relate to the second category: card is expired, card is lost, license is revoked from an issuing bank.

The system handles recurrent payment errors and responds differently depending on the category.

Cardholder Interaction

In case of decline due to insufficient funds on a card, the system informs a holder that the latest payment was failed and that the next attempt to write-off the fund will be the next day, and recommends to top up a card balance.

Retry

The system repeats withdrawal attempts for several days if subsequent payment fails due to recoverable error.

Card Data Update

The system offers to fill the form with a new card data to continue recurrent payments. If a customer agrees, the system effects a new setup payment using the details of the received card, adds the payment to the subscription, and continues regular payments using the updated card.

Payer Notification

An important function of recurring payments is timely informing a cardholder on the next payment date. Customers are used to forget about it, so the impendent withdrawal warning prevents insufficient funds on a card. CloudPayments always reminds customers of the next payment date indicating payment date, payment amount, payment description, and a payee.

SDK for iOS

The application demonstrates work with CloudPayments SDK for the iOS platform. You can download it from GitHub. There is also a new version of the SDK, you can try using it. It has successfully passed internal testing and is currently being tested with our pilot merchants. This is a beta version, but in the future it will completely replace the current version of the SDK - GitHub.

In this app you will learn how to get a card data, create a cryptogram, do a 3-D Secure authorization and make a payment on iPhone or iPad.

Terms of use:

- We strongly recommend you do not send any data for a payment from a mobile device directly to the CloudPayments API. Please store your credentials on your server to access the API, and support a thin client in a mobile application;

- Your server will not require a PCI certification as soon as it receives encrypted card data. Keys for a deencryption are available only in a CloudPayments’ payment gateway (they are not available either in application nor in a library);

- Card data can be entered using your keyboard or by scanning via your camera (for example, via card.io). A full number of a card and CVV cannot be stored or logged;

- The Mobile SDK cannot be used for mobile stations (mPos). The only usage is in applications which will be installed on phones and tablets of your buyers;

- According to AppStore rules, a mobile application developer has the right to accept payments using third-party payment systems only for selling non-digital goods, or those digital goods which can be used beyond the application.

SDK for Android

The application demonstrates work with CloudPayments SDK for the Android platform. You can download it from Github. There is also a new version of the SDK, you can try using it. It has successfully passed internal testing and is currently being tested with our pilot merchants. This is a beta version, but in the future it will completely replace the current version of the SDK - GitHub.

In this app you will learn how to get a card data, create a cryptogram, do a 3-D Secure authorization, and make a payment on Android devices.

Terms of use:

- We strongly recommend you do not send any data for a payment from a mobile device directly to the CloudPayments API. Please store your credentials on your server to access the API, and support a thin client in a mobile application;

- Your server will not require a PCI certification as soon as it receives encrypted card data. Keys for deencryption are available only in a CloudPayments’ payment gateway (they are not available either in application nor in a library);

- Card data can be entered using your keyboard or by scanning via your camera (for example, via card.io). A full number of a card and CVV cannot be stored or logged;

- The Mobile SDK cannot be used for mobile stations (mPos). The only usage is in applications which will be installed on phones and tablets of your customers;

- According to Google Play rules, a mobile application developer has the right to accept payments using third-party payment systems only for selling non-digital goods, or those digital goods which can be used beyond the application.

API

API is an application program interface to interact with Merchant's system.

Interaface works on api.cloudpayments.ru and provides functionality for making a payment, canceling a payment, refunding, confirming payments made according to a dual scheme mode, creating and canceling subscriptions for recurrent payments, and sending invoices by email.

Interface Basics

Parameters are sent by POST method in a request body in the “key = value” or JSON format.

An API can accept no more than 150,000 fields in a single request. The timeout for receiving a response from the API is 5 minutes.

In all requests to the API, if you pass a number with a fractional part to an integer field, then there will be no error, but mathematical rounding will occur.

The limit on the number of concurrent requests for test terminals is 5. If the number of currently processed any requests on test terminals is more than 5, then for subsequent requests api will return a response with HTTP code 429 (Too many Requests) until at least one request is processed.

Parameters` transfer format is determined on client side and can be changed in the request header Content- Type .

- For «key=value» parameters Content-Type is application/x-www-form-urlencoded;

- For JSON Content-Type parameters Content-Type is application/json;

The system returns a response in JSON format which includes at least two parameters: Success and Message:

{ "Success": false, "Message": "Invalid Amount value" }

Requests Authentication

For authentication HTTP Basic Auth is used which is sending a login and a password in a header of HTTP request. Public ID serves as a login and API Secret serves as a password. Both of these values you can get in the back office.

API Idempotency

Idempotency is an ability of API to produce the same result as the first one without re-processing in case of repeated requests. That means you can send several requests to the system with the same identifier, and only one request will be processed. All the responses will be identical. Thus the protection against network errors is implemented which can lead to creation of duplicate records and actions.

To enable idempotency, it is necessary to send a header with the X-Request-ID key containing a unique identifier in API request. Generation of request identifier remains on your side - it can be a guid, a combination of an order number, date and amount, or other values of your choice. Each new request that needs to be processed must include new X-Request-ID value. The processed result is stored in the system for 1 hour.

Test Method

The method to test the interaction with the API.

Method URL:

https://api.cloudpayments.ru/test

Parameters:

none.

Response example:

The method returns a request status.

{"Success":true,"Message":"bd6353c3-0ed6-4a65-946f-083664bf8dbd"}

Payment by a Cryptogram

The method to make a payment by a cryptogram generated by the Checkout script, Apple Pay, or Google Pay.

Method URL's:

https://api.cloudpayments.ru/payments/cards/charge — for single message scheme payment

https://api.cloudpayments.ru/payments/cards/auth — for dual message scheme payment

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Amount | Numeric | Required | Payment amount |

| Currency | String | Required | Currency : RUB/USD/EUR/GBP (see the reference) |

| IpAddress | String | Required | Payer's IP address |

| Name | String | Required for all, except of Apple Pay & Google Pay | Cardholder name in latin |

| CardCryptogramPacket | String | Required | Cryptogram |

| paymentUrl | String | Optional | The address of the site from which the checkout script is called |

| InvoiceId | String | Optional | Invoice or order number |

| Description | String | Optional | Payment description |

| CultureName | String | Optional | Language of notifications. Possible values: "ru-RU", "en-US". (see reference) |

| AccountId | String | Optional | Payer's ID (Required for Subscription creation and receiving of correct token) |

| String | Optional | Payer's E-mail to send an online-receipt to | |

| Payer | Object | Optional | An additional field where information about the payer is transferred. Use the following parameters: FirstName, LastName, MiddleName, Birth, Street, Address, City, Country, Phone, Postcode |

| JsonData | Json | Optional | Any other data that will be associated with transaction including instructions for Subsctiption creation or generation of online-receipt. We reserved the names of the following parameters and display it in the registry of operations which you can download in Back Office: name, firstName, middleName, lastName, nick, phone, address, comment, birthDate. |

The server returns JSON response with three components:

- field success — request result;

- field message — error description;

- object model — extended information.

Possible response options:

- Incorrect request:

success — false

message — error description - 3-D Secure authentication is required (not applicable to Apple Pay):

success — false

model — authentication information - Transaction rejected:

success — false

model — transaction information and error code - Transaction accepted:

success — true

model — transaction information

Payment by a cryptogram request example:

{

"Amount":10,

"Currency":"RUB",

"InvoiceId":"1234567",

"Description":"Order №1234567 in shop example.com",

"AccountId":"user_x",

"Name":"CARDHOLDER NAME", // CardCryptogramPacket Required parameter

"CardCryptogramPacket":"01492500008719030128SMfLeYdKp5dSQVIiO5l6ZCJiPdel4uDjdFTTz1UnXY+3QaZcNOW8lmXg0H670MclS4lI+qLkujKF4pR5Ri+T/E04Ufq3t5ntMUVLuZ998DLm+OVHV7FxIGR7snckpg47A73v7/y88Q5dxxvVZtDVi0qCcJAiZrgKLyLCqypnMfhjsgCEPF6d4OMzkgNQiynZvKysI2q+xc9cL0+CMmQTUPytnxX52k9qLNZ55cnE8kuLvqSK+TOG7Fz03moGcVvbb9XTg1oTDL4pl9rgkG3XvvTJOwol3JDxL1i6x+VpaRxpLJg0Zd9/9xRJOBMGmwAxo8/xyvGuAj85sxLJL6fA==",

"Payer":

{

"FirstName":"Test",

"LastName":"Test",

"MiddleName":"Test",

"Birth":"1955-02-24",

"Address":"test address",

"Street":"Lenins",

"City":"MO",

"Country":"RU",

"Phone":"123",

"Postcode":"345"

}

}

Response example: incorrect request:

{"Success":false,"Message":"Amount is required"}

Response example: 3-D Secure authentication is required

{

"Model": {

"TransactionId": 504,

"PaReq": "eJxVUdtugkAQ/RXDe9mLgo0Z1nhpU9PQasWmPhLYAKksuEChfn13uVR9mGTO7MzZM2dg3qSn0Q+X\nRZIJxyAmNkZcBFmYiMgxDt7zw6MxZ+DFkvP1ngeV5AxcXhR+xEdJ6BhpEZnEYLBdfPAzg56JKSKT\nAhqgGpFB7IuSgR+cl5s3NqFTG2NAPYSUy82aETqeWPYUUAdB+ClnwSmrwtz/TbkoC0BtDYKsEqX8\nZfZkDGgAUMkTi8synyFU17V5N2nKCpBuAHRVs610VijCJgmZu17UXTxhFWP34l7evYPlegsHkO6A\n0C85o5hMsI3piNIZHc+IBaitg59qJYzgdrUOQK7/WNy+3FZAeSqV5cMqAwLe5JlQwpny8T8HdFW8\netFuBqUyahV+Hjf27vWCaSx22fe+KY6kXKZfJLK1x22TZkyUS8QiHaUGgDQN6s+H+tOq7O7kf8hd\nt30=",

"AcsUrl": "https://test.paymentgate.ru/acs/auth/start.do"

},

"Success": false,

"Message": null

}

Response example: Transaction rejected. ReasonCode field contains error code (see the reference):

{

"Model": {

"TransactionId": 504,

"Amount": 10.00000,

"Currency": "RUB",

"CurrencyCode": 0,

"PaymentAmount": 10.00000,

"PaymentCurrency": "RUB",

"PaymentCurrencyCode": 0,

"InvoiceId": "1234567",

"AccountId": "user_x",

"Email": null,

"Description": "Order №1234567 in shop example.com",

"JsonData": null,

"CreatedDate": "\/Date(1401718880000)\/",

"CreatedDateIso":"2014-08-09T11:49:41", //all dates in UTC format

"TestMode": true,

"IpAddress": "195.91.194.13",

"IpCountry": "RU",

"IpCity": "Ufa",

"IpRegion": "Республика Башкортостан",

"IpDistrict": "Приволжский федеральный округ",

"IpLatitude": 54.7355,

"IpLongitude": 55.991982,

"CardFirstSix": "411111",

"CardLastFour": "1111",

"CardExpDate": "05/19",

"CardType": "Visa",

"CardTypeCode": 0,

"Issuer": "Sberbank of Russia",

"IssuerBankCountry": "RU",

"Status": "Declined",

"StatusCode": 5,

"Reason": "InsufficientFunds", // reason of rejection

"ReasonCode": 5051, //rejection code

"CardHolderMessage":"Not enough funds on the card", //message for a payer

"Name": "CARDHOLDER NAME",

},

"Success": false,

"Message": null

}

Response example: transaction accepted:

{

"Model": {

"TransactionId": 504,

"Amount": 10.00000,

"Currency": "RUB",

"CurrencyCode": 0,

"InvoiceId": "1234567",

"AccountId": "user_x",

"Email": null,

"Description": "Оrder №1234567 in shop example.com",

"JsonData": null,

"CreatedDate": "\/Date(1401718880000)\/",

"CreatedDateIso":"2014-08-09T11:49:41", //all the dates in UTC format

"AuthDate": "\/Date(1401733880523)\/",

"AuthDateIso":"2014-08-09T11:49:42",

"ConfirmDate": "\/Date(1401733880523)\/",

"ConfirmDateIso":"2014-08-09T11:49:42",

"AuthCode": "123456",

"TestMode": true,

"IpAddress": "195.91.194.13",

"IpCountry": "RU",

"IpCity": "Ufa",

"IpRegion": "Республика Башкортостан",

"IpDistrict": "Приволжский федеральный округ",

"IpLatitude": 54.7355,

"IpLongitude": 55.991982,

"CardFirstSix": "411111",

"CardLastFour": "1111",

"CardExpDate": "05/19",

"CardType": "Visa",

"CardTypeCode": 0,

"Issuer": "Sberbank of Russia",

"IssuerBankCountry": "RU",

"Status": "Completed",

"StatusCode": 3,

"Reason": "Approved",

"ReasonCode": 0,

"CardHolderMessage":"ayment successfully completed", //message for a payer

"Name": "CARDHOLDER NAME",

"Token": "a4e67841-abb0-42de-a364-d1d8f9f4b3c0"

},

"Success": true,

"Message": null

}

3-D Secure Processing

To complete 3-D Secure authentication , you need to divert a payer to the address specified in the AcsUrl parameter of server's response with following parameters:

- MD — TransactionId parameter from server response

- PaReq — same parameter from server response

- TermUrl — the address on your site for returning the payer once authentication successful

Form example:

<form name="downloadForm" action="AcsUrl" method="POST">

<input type="hidden" name="PaReq" value="eJxVUdtugkAQ/RXDe9mLgo0Z1nhpU9PQasWmPhLYAKksuEChfn13uVR9mGTO7MzZM2dg3qSn0Q+X\nRZIJxyAmNkZcBFmYiMgxDt7zw6MxZ+DFkvP1ngeV5AxcXhR+xEdJ6BhpEZnEYLBdfPAzg56JKSKT\nAhqgGpFB7IuSgR+cl5s3NqFTG2NAPYSUy82aETqeWPYUUAdB+ClnwSmrwtz/TbkoC0BtDYKsEqX8\nZfZkDGgAUMkTi8synyFU17V5N2nKCpBuAHRVs610VijCJgmZu17UXTxhFWP34l7evYPlegsHkO6A\n0C85o5hMsI3piNIZHc+IBaitg59qJYzgdrUOQK7/WNy+3FZAeSqV5cMqAwLe5JlQwpny8T8HdFW8\netFuBqUyahV+Hjf27vWCaSx22fe+KY6kXKZfJLK1x22TZkyUS8QiHaUGgDQN6s+H+tOq7O7kf8hd\nt30=">

<input type="hidden" name="MD" value="504">

<input type="hidden" name="TermUrl" value="https://example.com/post3ds?order=1234567">

</form>

<script>

window.onload = submitForm;

function submitForm() { downloadForm.submit(); }

</script>

To complete the payment, use the following Post3ds method.

Method URL:

https://api.cloudpayments.ru/payments/cards/post3ds

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| TransactionId | Int | Required | MD parameter value |

| PaRes | String | Required | PaRes value |

The server will return either information about successful transaction or declined in response to correctly created request.

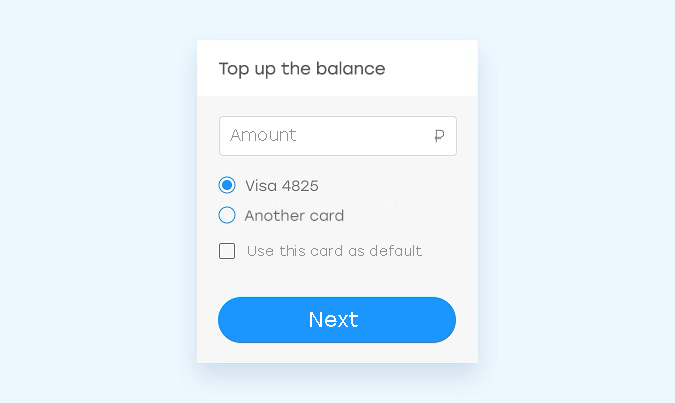

Payment by a Token (Recurring)

The method to make a payment by a token received either with payment by cryptogram or via Pay notification.

Method URL's:

https://api.cloudpayments.ru/payments/tokens/charge — for single message scheme payment.

https://api.cloudpayments.ru/payments/tokens/auth — for dual message scheme payment.

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Amount | Numeric | Required | Amount of payment |

| Currency | String | Required | RUB/USD/EUR/GBP (see the reference) |

| AccountId | String | Required | Payer's ID |

| Token | String | Required | Card tokens issued by the system. You get it with the first successful payment |

| InvoiceId | String | Optional | Order or invoice number |

| Description | String | Optional | Payment description/purpose |

| IpAddress | String | Optional | Payer's IP address |

| String | Optional | Payer's E-mail to send an online-receipt to | |

| JsonData | Json | Optional | Any other data that will be associated with the transaction, including the instructions for Subsctiption creation or generation of online-receipt. We reserved the names of the following parameters and display it in the registry of operations, which you may download in Back Office: name, firstName, middleName, lastName, nick, phone, address, comment, birthDate. |

The server returns JSON response with three components:

- field success — request result;

- field message — error description;

- object model — extended information.

Possible response options:

- Incorrect request:

success — false

message — error description - Transaction rejected:

success — false

model — transaction information and error code - Transaction accepted:

success — true

model — transaction information

Payment by token request example:

{

"Amount":10,

"Currency":"RUB",

"InvoiceId":"1234567",

"Description":"Order №1234567 in shop example.com",

"AccountId":"user_x",

"Token":"a4e67841-abb0-42de-a364-d1d8f9f4b3c0"

}

Response example: incorrect request

{"Success":false,"Message":"Amount is required"}

Response example: transaction rejected. ReasonCode field contains an error code (see the reference):

{

"Model": {

"TransactionId": 504,

"Amount": 10.00000,

"Currency": "RUB",

"CurrencyCode": 0,

"InvoiceId": "1234567",

"AccountId": "user_x",

"Email": null,

"Description": "Order №1234567 in shop example.com",

"JsonData": null,

"CreatedDate": "\/Date(1401718880000)\/",

"CreatedDateIso":"2014-08-09T11:49:41", //all the dates in UTC format

"TestMode": true,

"IpAddress": "195.91.194.13",

"IpCountry": "RU",

"IpCity": "Ufa",

"IpRegion": "Республика Башкортостан",

"IpDistrict": "Приволжский федеральный округ",

"IpLatitude": 54.7355,

"IpLongitude": 55.991982,

"CardFirstSix": "411111",

"CardLastFour": "1111",

"CardType": "Visa",

"CardTypeCode": 0,

"Issuer": "Sberbank of Russia",

"IssuerBankCountry": "RU",

"Status": "Declined",

"StatusCode": 5,

"Reason": "InsufficientFunds", //decline reason

"ReasonCode": 5051,

"CardHolderMessage":"Недостаточно средств на карте", //message for a payer

"Name": "CARDHOLDER NAME",

},

"Success": false,

"Message": null

}

Response example: transaction accepted

{

"Model": {

"TransactionId": 504,

"Amount": 10.00000,

"Currency": "RUB",

"CurrencyCode": 0,

"InvoiceId": "1234567",

"AccountId": "user_x",

"Email": null,

"Description": "Order №1234567 in shop example.com",

"JsonData": null,

"CreatedDate": "\/Date(1401718880000)\/",

"CreatedDateIso":"2014-08-09T11:49:41", //all the dates in UTC format

"AuthDate": "\/Date(1401733880523)\/",

"AuthDateIso":"2014-08-09T11:49:42",

"ConfirmDate": "\/Date(1401733880523)\/",

"ConfirmDateIso":"2014-08-09T11:49:42",

"AuthCode": "123456",

"TestMode": true,

"IpAddress": "195.91.194.13",

"IpCountry": "RU",

"IpCity": "Уфа",

"IpRegion": "Республика Башкортостан",

"IpDistrict": "Приволжский федеральный округ",

"IpLatitude": 54.7355,

"IpLongitude": 55.991982,

"CardFirstSix": "411111",

"CardLastFour": "1111",

"CardType": "Visa",

"CardTypeCode": 0,

"Issuer": "Sberbank of Russia",

"IssuerBankCountry": "RU",

"Status": "Completed",

"StatusCode": 3,

"Reason": "Approved",

"ReasonCode": 0,

"CardHolderMessage":"Оплата успешно проведена", //message for a payer

"Name": "CARDHOLDER NAME",

"Token": "a4e67841-abb0-42de-a364-d1d8f9f4b3c0"

},

"Success": true,

"Message": null

}

Payment Confirmation

For payments made by DMS scheme you need to confirm a transaction. Confirmation can be done through Back office or via callig this API method.

Method URL:

https://api.cloudpayments.ru/payments/confirm

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| TransactionId | Int | Required | Systems transaction number |

| Amount | Numeric | Required | Amount to confirm in currency of transaction |

| JsonData | Json | Optional | Any other data that will be associated with transaction including the instructions for generation of online-receipt |

Request example:

{"TransactionId":455,"Amount":65.98}

Response example:

{"Success":true,"Message":null}

Payment Cancellation

Cancellation of payment can be executed through your Back Office or by calling of the API method.

Method URL:

https://api.cloudpayments.ru/payments/void

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| TransactionId | Int | Required | Systems transaction number |

Request example:

{"TransactionId":455}

Response example:

{"Success":true,"Message":null}

Refund

Refund can be executed through your Back Office or by calling of the API method.

Method URL:

https://api.cloudpayments.ru/payments/refund

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| TransactionId | Int | Required | Systems transaction number |

| Amount | Numeric | Required | Refund amount in currency of transaction |

| JsonData | Json | Optional | Any other data that will be associated with the transaction, including the instructions for generation of online-receipt |

Request example:

{"TransactionId":455, "Amount": 100}

Response example:

{

"Model": {

"TransactionId": 568

},

"Success": true,

"Message": null

}

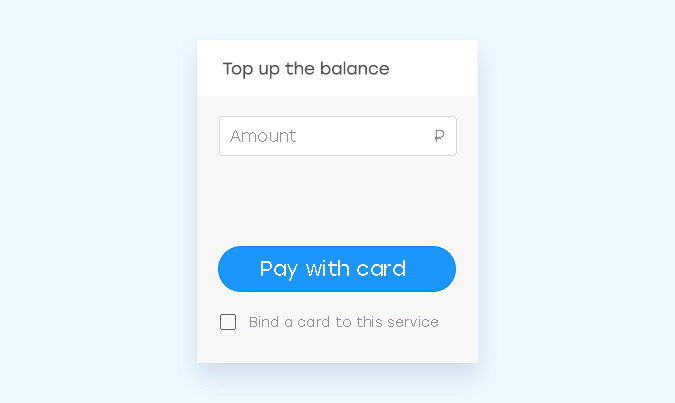

Payout by a Cryptogram

Payment by a cryptogram can be executed through calling of this API method.

Method URL:

https://api.cloudpayments.ru/payments/cards/topup

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Name | String | Required | Cardholder Name in Latin |

| CardCryptogramPacket | String | Required | Payment Cryptogram |

| Amount | Numeric | Required | Payment Amount |

| AccountId | String | Required | Payer's ID |

| String | Optional | Payer's E-mail to send an online-receipt to | |

| JsonData | Json | Optional | Any other data that will be associated with the transaction. We reserved the names of the following parameters and display it in the registry of operations, which you may download in Back Office: name, firstName, middleName, lastName, nick, phone, address, comment, birthDate |

| Currency | String | Required | Currency |

| InvoiceId | String | Optional | Order or invoice number |

| Description | String | Optional | Payment description/purpose |

| Payer | Object | Optional | Additional field where information about the payer is sent |

| Receiver | Object | Optional | Additional field where information about the recipient is sent |

Request example:

{

"Name":"CARDHOLDER NAME",

"CardCryptogramPacket":"01492500008719030128SMfLeYdKp5dSQVIiO5l6ZCJiPdel4uDjdFTTz1UnXY+3QaZcNOW8lmXg0H670MclS4lI+qLkujKF4pR5Ri+T/E04Ufq3t5ntMUVLuZ998DLm+OVHV7FxIGR7snckpg47A73v7/y88Q5dxxvVZtDVi0qCcJAiZrgKLyLCqypnMfhjsgCEPF6d4OMzkgNQiynZvKysI2q+xc9cL0+CMmQTUPytnxX52k9qLNZ55cnE8kuLvqSK+TOG7Fz03moGcVvbb9XTg1oTDL4pl9rgkG3XvvTJOwol3JDxL1i6x+VpaRxpLJg0Zd9/9xRJOBMGmwAxo8/xyvGuAj85sxLJL6fA==",

"Amount":1,

"AccountId":"user@example.com",

"Currency":"RUB"

"InvoiceId":"1234567",

"Payer":

//The set of fields is the same for the Receiver parameter.

{

"FirstName":"Test",

"LastName":"Test",

"MiddleName":"Test",

"Birth":"1955-02-24",

"Address":"test address",

"Street":"Lenins",

"City":"MO",

"Country":"RU",

"Phone":"123",

"Postcode":"345"

}

}

Response example:

{

"Model":{

"PublicId":"pk_b9b86395c99782f0d16386d83e5d8",

"TransactionId":100551,

"Amount":1,

"Currency":"RUB",

"PaymentAmount":1,

"PaymentCurrency":"RUB",

"AccountId":"user@example.com",

"Email":null,

"Description":null,

"JsonData":null,

"CreatedDate":"/Date(1517943890884)/",

"PayoutDate":"/Date(1517950800000)/",

"PayoutDateIso":"2018-02-07T00:00:00",

"PayoutAmount":1,

"CreatedDateIso":"2018-02-06T19:04:50",

"AuthDate":"/Date(1517943899268)/",

"AuthDateIso":"2018-02-06T19:04:59",

"ConfirmDate":"/Date(1517943899268)/",

"ConfirmDateIso":"2018-02-06T19:04:59",

"AuthCode":"031365",

"TestMode":false,

"Rrn":"568879820",

"OriginalTransactionId":null,

"IpAddress":"185.8.6.164",

"IpCountry":"RU",

"IpCity":"Москва",

"IpRegion":null,

"IpDistrict":"Москва",

"IpLatitude":55.75222,

"IpLongitude":37.61556,

"CardFirstSix":"411111",

"CardLastFour":"1111",

"CardExpDate":"12/22",

"CardType":"Visa",

"CardTypeCode":0,

"Status":"Completed",

"StatusCode":3,

"CultureName":"ru",

"Reason":"Approved",

"ReasonCode":0,

"CardHolderMessage":"Оплата успешно проведена",

"Type":2,

"Refunded":false,

"Name":"WQER",

"SubscriptionId":null,

"GatewayName":"Tinkoff Payout"

},

"Success":true,

"Message":null

}

Payout by a Token

Payout by a token can be executed through calling of the following API method.

Method URL:

https://api.cloudpayments.ru/payments/token/topup

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Token | String | Required | Card tokens issued by the system. You get it with the first successful payment |

| Amount | Numeric | Required | Payment Amount |

| AccountId | String | Required | Payer's ID |

| Currency | String | Required | Currency |

| InvoiceId | String | Optional | Order or invoice number |

| Payer | Object | Optional | Additional field where information about the payer is sent |

| Receiver | Object | Optional | Additional field where information about the recipient is sent |

Request example:

{

"Token":"a4e67841-abb0-42de-a364-d1d8f9f4b3c0",

"Amount":1,

"AccountId":"user@example.com",

"Currency":"RUB",

"Payer":

//The set of fields is the same for the Receiver parameter.

{

"FirstName":"Test",

"LastName":"Test",

"MiddleName":"Test",

"Birth":"1955-02-24",

"Address":"test address",

"Street":"Lenins",

"City":"MO",

"Country":"RU",

"Phone":"123",

"Postcode":"345"

}

}

Response example:

{

"Model":{

"PublicId":"pk_b9b86395c99782f0d16386d83e5d8",

"TransactionId":100551,

"Amount":1,

"Currency":"RUB",

"PaymentAmount":1,

"PaymentCurrency":"RUB",

"AccountId":"user@example.com",

"Email":null,

"Description":null,

"JsonData":null,

"CreatedDate":"/Date(1517943890884)/",

"PayoutDate":"/Date(1517950800000)/",

"PayoutDateIso":"2018-02-07T00:00:00",

"PayoutAmount":1,

"CreatedDateIso":"2018-02-06T19:04:50",

"AuthDate":"/Date(1517943899268)/",

"AuthDateIso":"2018-02-06T19:04:59",

"ConfirmDate":"/Date(1517943899268)/",

"ConfirmDateIso":"2018-02-06T19:04:59",

"AuthCode":"031365",

"TestMode":false,

"Rrn":"568879820",

"OriginalTransactionId":null,

"IpAddress":"185.8.6.164",

"IpCountry":"RU",

"IpCity":"Москва",

"IpRegion":null,

"IpDistrict":"Москва",

"IpLatitude":55.75222,

"IpLongitude":37.61556,

"CardFirstSix":"411111",

"CardLastFour":"1111",

"CardExpDate":"12/22",

"CardType":"Visa",

"CardTypeCode":0,

"Status":"Completed",

"StatusCode":3,

"CultureName":"ru",

"Reason":"Approved",

"ReasonCode":0,

"CardHolderMessage":"Оплата успешно проведена",

"Type":2,

"Refunded":false,

"Name":"WQER",

"SubscriptionId":null,

"GatewayName":"Tinkoff Payout"

},

"Success":true,

"Message":null

}

Transaction Details

The method returns a transaction details.

Method URL:

https://api.cloudpayments.ru/payments/get

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| TransactionId | Int | Required | Transaction number |

If transaction is found, the system returns information about it.

Request example:

{"TransactionId":504}

Response example:

{

"Model": {

"TransactionId": 504,

"Amount": 10.00000,

"Currency": "RUB",

"CurrencyCode": 0,

"InvoiceId": "1234567",

"AccountId": "user_x",

"Email": null,

"Description": "Order №1234567 in shop example.com",

"JsonData": null,

"CreatedDate": "\/Date(1401718880000)\/",

"CreatedDateIso":"2014-08-09T11:49:41", //all the dates are in UTC format

"AuthDate": "\/Date(1401733880523)\/",

"AuthDateIso":"2014-08-09T11:49:42",

"ConfirmDate": "\/Date(1401733880523)\/",

"ConfirmDateIso":"2014-08-09T11:49:42",

"PayoutDate": "\/Date(1401733880523)\/",

"PayoutDateIso":"2014-08-09T11:49:42",

"PayoutAmount": 99.61,

"TestMode": true,

"IpAddress": "195.91.194.13",

"IpCountry": "RU",

"IpCity": "Уфа",

"IpRegion": "Республика Башкортостан",

"IpDistrict": "Приволжский федеральный округ",

"IpLatitude": 54.7355,

"IpLongitude": 55.991982,

"CardFirstSix": "411111",

"CardLastFour": "1111",

"CardExpDate": "05/19",

"CardType": "Visa",

"CardTypeCode": 0,

"Issuer": "Sberbank of Russia",

"IssuerBankCountry": "RU",

"Status": "Completed",

"StatusCode": 3,

"Reason": "Approved",

"ReasonCode": 0,

"CardHolderMessage":"Оплата успешно проведена", //message for payer

"Name": "CARDHOLDER NAME",

},

"Success": true,

"Message": null

}

Payment Status Check

The method for payment searching which returns it's status (see the reference).

Method URL (old) :

https://api.cloudpayments.ru/payments/find

Method URL (new):

https://api.cloudpayments.ru/v2/payments/find

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| InvoiceId | String | Required | Order or invoice number |

If a payment for the specified order number is found, the system will return either information about the successful transaction or about the declined If several payments with the specified order number are found, the system will return information about the latest operation only. The difference of the new method is that it searches for all payments, including refunds and payments to the card.

Request example:

{"InvoiceId":"123456789"}

Response example:

{"Success":false,"Message":"Not found"}

Transaction List

The method to get a list of transactions for a day.

Method URL:

https://api.cloudpayments.ru/payments/list

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Date | Date | Required | Date to check |

| TimeZone | String | Optional | Time zone code, UTC by default |

All the transactions registered on the specified day will be returned in the list. For your convenience, you can specify the time zone code (see the reference)

Request example:

{"Date":"2019-02-21", "TimeZone": "MSK"}

Response example:

{

"Model": [{

"TransactionId": 504,

"Amount": 10.00000,

"Currency": "RUB",

"CurrencyCode": 0,

"InvoiceId": "1234567",

"AccountId": "user_x",

"Email": null,

"Description": "Payment at example.com",

"JsonData": null,

"CreatedDate": "\/Date(1401718880000)\/",

"CreatedDateIso":"2014-08-09T11:49:41", //all the dates are in chosen time zone

"AuthDate": "\/Date(1401733880523)\/",

"AuthDateIso":"2014-08-09T11:49:42",

"ConfirmDate": "\/Date(1401733880523)\/",

"ConfirmDateIso":"2014-08-09T11:49:42",

"PayoutDate": "\/Date(1401733880523)\/",

"PayoutDateIso":"2014-08-09T11:49:42",

"PayoutAmount": 99.61,

"TestMode": true,

"IpAddress": "195.91.194.13",

"IpCountry": "RU",

"IpCity": "Уфа",

"IpRegion": "Республика Башкортостан",

"IpDistrict": "Приволжский федеральный округ",

"IpLatitude": 54.7355,

"IpLongitude": 55.991982,

"CardFirstSix": "411111",

"CardLastFour": "1111",

"CardExpDate": "05/19",

"CardType": "Visa",

"CardTypeCode": 0,

"Issuer": "Sberbank of Russia",

"IssuerBankCountry": "RU",

"Status": "Completed",

"StatusCode": 3,

"Reason": "Approved",

"ReasonCode": 0,

"CardHolderMessage":"Оплата успешно проведена", //message for payer

"Name": "CARDHOLDER NAME",

}],

"Success": true,

}

Token List

The method to get a list of all payment tokens of CloudPayments.

Method URL:

https://api.cloudpayments.ru/payments/tokens/list

Parameters:

none.

Response example:

{

"Model": [

{

"Token": "tk_020a924486aa4df254331afa33f2a",

"AccountId": "user_x",

"CardMask": "4242 42****** 4242",

"ExpirationDateMonth": 12,

"ExpirationDateYear": 2020

},

{

"Token": "tk_1a9f2f10253a30a7c5692a3fc4c17",

"AccountId": "user_x",

"CardMask": "5555 55****** 4444",

"ExpirationDateMonth": 12,

"ExpirationDateYear": 2021

},

{

"Token": "tk_b91062f0f2875909233ab66d0fc7b",

"AccountId": "user_x",

"CardMask": "4012 88****** 1881",

"ExpirationDateMonth": 12,

"ExpirationDateYear": 2022

}

],

"Success": true,

"Message": null

}

Creation of Subscriptions on Recurrent Payments

The method to create subscriptions on recurrent payments.

Method URL:

https://api.cloudpayments.ru/subscriptions/create

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Token | String | Required | Card tokens issued by the system after the first payment |

| AccountId | String | Required | Payer's ID |

| Description | String | Required | Payment description/purpose |

| String | Required | Payer's E-mail | |

| Amount | Numeric | Required | Payment amount |

| Currency | String | Required | Currency: RUB/USD/EUR/GBP (see the reference) |

| RequireConfirmation | Bool | Required | If true — payments will work by DMS |

| StartDate | DateTime | Required | Date time of the first subscription payment in UTC timezone |

| Interval | String | Required | Possible values: Day, Week, Month |

| Period | Int | Required | Works in combination with the Interval, 1 Month means once per mont, 2 Week means once per two weeks |

| MaxPeriods | Int | Optional | Maximum quantity of subscription payments |

| CustomerReceipt | String | Optional | For content of an online-receipt changing. |

The system returns a message about the successful operation and the subscription identifier in response to correctly created request.

Request example:

{

"token":"477BBA133C182267FE5F086924ABDC5DB71F77BFC27F01F2843F2CDC69D89F05",

"accountId":"user@example.com",

"description":"Monthly subscription on some service at example.com",

"email":"user@example.com",

"amount":1.02,

"currency":"RUB",

"requireConfirmation":false,

"startDate":"2014-08-06T16:46:29.5377246Z",

"interval":"Month",

"period":1

}

Response example:

{

"Model":{

"Id":"sc_8cf8a9338fb8ebf7202b08d09c938", //Subscription ID

"AccountId":"user@example.com",

"Description":"Monthly subscription on some service at example.com"

"Email":"user@example.com",

"Amount":1.02,

"CurrencyCode":0,

"Currency":"RUB",

"RequireConfirmation":false, //true for enabling the DMS

"StartDate":"\/Date(1407343589537)\/",

"StartDateIso":"2014-08-09T11:49:41", //all the dates are in UTC

"IntervalCode":1,

"Interval":"Month",

"Period":1,

"MaxPeriods":null,

"StatusCode":0,

"Status":"Active",

"SuccessfulTransactionsNumber":0,

"FailedTransactionsNumber":0,

"LastTransactionDate":null,

"LastTransactionDateIso":null,

"NextTransactionDate":"\/Date(1407343589537)\/"

"NextTransactionDateIso":"2014-08-09T11:49:41"

},

"Success":true

}

Subscription Details

The method to get an information about subscription status.

Method URL:

https://api.cloudpayments.ru/subscriptions/get

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Id | String | Required | Subscription ID |

Request example:

{"Id":"sc_8cf8a9338fb8ebf7202b08d09c938"}

Response example:

{

"Model":{

"Id":"sc_8cf8a9338fb8ebf7202b08d09c938", //Subscription ID

"AccountId":"user@example.com",

"Description":"Monthly subscription on some service at example.com",

"Email":"user@example.com",

"Amount":1.02,

"CurrencyCode":0,

"Currency":"RUB",

"RequireConfirmation":false, //true for enabling the DMS

"StartDate":"\/Date(1407343589537)\/",

"StartDateIso":"2014-08-09T11:49:41", //all the dates are in UTC

"IntervalCode":1,

"Interval":"Month",

"Period":1,

"MaxPeriods":null,

"StatusCode":0,

"Status":"Active",

"SuccessfulTransactionsNumber":0,

"FailedTransactionsNumber":0,

"LastTransactionDate":null,

"LastTransactionDateIso":null,

"NextTransactionDate":"\/Date(1407343589537)\/"

"NextTransactionDateIso":"2014-08-09T11:49:41"

},

"Success":true

}

Subscriptions Search

The method to get a list of subscriptions for a particular account.

Method URL:

https://api.cloudpayments.ru/subscriptions/find

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| accountId | String | Required | Subscription ID |

Request example:

{"accountId":"user@example.com"}

Response example:

{

"Model": [

{

"Id": "sc_4bae8f5823bb8cdc966ccd1590a3b",

"AccountId": "user@example.com",

"Description": "Subscription on some service",

"Email": "user@example.com",

"Amount": 1.02,

"CurrencyCode": 0,

"Currency": "RUB",

"RequireConfirmation": false,

"StartDate": "/Date(1473665268000)/",

"StartDateIso": "2016-09-12T15:27:48",

"IntervalCode": 1,

"Interval": "Month",

"Period": 1,

"MaxPeriods": null,

"CultureName": "ru",

"StatusCode": 0,

"Status": "Active",

"SuccessfulTransactionsNumber": 0,

"FailedTransactionsNumber": 0,

"LastTransactionDate": null,

"LastTransactionDateIso": null,

"NextTransactionDate": "/Date(1473665268000)/",

"NextTransactionDateIso": "2016-09-12T15:27:48"

},

{

"Id": "sc_b4bdedba0e2bdf279be2e0bab9c99",

"AccountId": "user@example.com",

"Description": "Subscription on some service #2",

"Email": "user@example.com",

"Amount": 3.04,

"CurrencyCode": 0,

"Currency": "RUB",

"RequireConfirmation": false,

"StartDate": "/Date(1473665268000)/",

"StartDateIso": "2016-09-12T15:27:48",

"IntervalCode": 0,

"Interval": "Week",

"Period": 2,

"MaxPeriods": null,

"CultureName": "ru",

"StatusCode": 0,

"Status": "Active",

"SuccessfulTransactionsNumber": 0,

"FailedTransactionsNumber": 0,

"LastTransactionDate": null,

"LastTransactionDateIso": null,

"NextTransactionDate": "/Date(1473665268000)/",

"NextTransactionDateIso": "2016-09-12T15:27:48"

}

],

"Success": true,

"Message": null

}

Recurrent Payments Subscription Change

The method to change a subscription on recurrent payments.

Method URL:

https://api.cloudpayments.ru/subscriptions/update

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Id | String | Required | Subscription ID |

| Description | String | Optional | Description of change |

| Amount | Numeric | Optional | Amount to change to |

| Currency | String | Optional | Currency: RUB/USD/EUR/GBP (see the reference) |

| RequireConfirmation | Bool | Optional | If true — payments will work by DMS |

| StartDate | DateTime | Optional | For date of the first (or the next following) payment in UTC zone changing. |

| Interval | String | Optional | For interval changing. Possible values: Week, Month |

| Period | Int | Optional | For period changing. In combination with the Interval, 1 Month means once per month, 2 Week means once per two weeks. |

| MaxPeriods | Int | Optional | For max periods of recurring payments changing. |

| CustomerReceipt | String | Optional | For content of an online-receipt changing. |

The system returns a message with the successful operation and subscription parameters in response to correctly created request.

Request example:

{

"Id":"sc_8cf8a9338fb8ebf7202b08d09c938",

"description":"Rate №5",

"amount":1200,

"currency":"RUB"

}

Response example:

{

"Model":{

"Id":"sc_8cf8a9338fb8ebf7202b08d09c938", //Subscription ID

"AccountId":"user@example.com",

"Description":"Rate №5",

"Email":"user@example.com",

"Amount":1200,

"CurrencyCode":0,

"Currency":"RUB",

"RequireConfirmation":false, //true for enabling the DMS

"StartDate":"\/Date(1407343589537)\/",

"StartDateIso":"2014-08-09T11:49:41", //all the dates are in UTC

"IntervalCode":1,

"Interval":"Month",

"Period":1,

"MaxPeriods":null,

"StatusCode":0,

"Status":"Active",

"SuccessfulTransactionsNumber":0,

"FailedTransactionsNumber":0,

"LastTransactionDate":null,

"LastTransactionDateIso":null,

"NextTransactionDate":"\/Date(1407343589537)\/"

"NextTransactionDateIso":"2014-08-09T11:49:41"

},

"Success":true

}

Subscription on Recurrent Payments Cancellation

The method to cancel subscription on recurrent payments.

Method URL:

https://api.cloudpayments.ru/subscriptions/cancel

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Id | String | Required | Subscription ID |

The system returns a message about the successful operation in response to correctly created request.

Request example:

{"Id":"sc_cc673fdc50b3577e60eee9081e440"}

Response example:

{"Success":true,"Message":null}

You can also provide a link to the system’s website — https://my.cloudpayments.ru/unsubscribe, where payer can independently find and cancel his or her regular payments.

Invoice Creation on Email

The method to generate a payment link and sending it to a payer's email.

Method URL:

https://api.cloudpayments.ru/orders/create

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Amount | Numeric | Required | Payment Amount |

| Currency | String | Required | Currency: RUB/USD/EUR/GBP (see the reference) |

| Description | String | Required | Payment description/purpose |

| String | Optional | Payer's E-mail | |

| RequireConfirmation | Bool | Optional | If true — payments will work by DMS |

| SendEmail | Bool | Optional | If true — payer will get an email with the link on the invoice |

| InvoiceId | String | Optional | Order or Invoice number |

| AccountId | String | Optional | Payer's ID |

| OfferUri | String | Optional | Link to the offer that will be shown on the order page |

| Phone | String | Optional | Free format phone number of the payer |

| SendSms | Bool | Optional | If true — payer will get a SMS with the link on the invoice |

| SendViber | Bool | Optional | If true — payer will get a Viber message with the link on the invoice |

| CultureName | String | Optional | Notifications language. Possible values: "ru-RU", "en-US" |

| SubscriptionBehavior | String | Optional | For subscription creation. Possible values: CreateWeekly, CreateMonthly |

| SuccessRedirectUrl | String | Optional | Page address for redirect upon successful payment |

| FailRedirectUrl | String | Optional | Page address for redirecting in case of unsuccessful payment |

| JsonData | Json | Optional | Any other data that will be associated with the transaction, including the instructions for generation of online-receipt |

Request example:

{

"Amount":10.0,

"Currency":"RUB",

"Description":"Payment at website example.com",

"Email":"client@test.local",

"RequireConfirmation":true,

"SendEmail":false

}

Response example:

{

"Model":{

"Id":"f2K8LV6reGE9WBFn",

"Number":61,

"Amount":10.0,

"Currency":"RUB",

"CurrencyCode":0,

"Email":"client@test.local",

"Description":"Payment at website example.com",

"RequireConfirmation":true,

"Url":"https://orders.cloudpayments.ru/d/f2K8LV6reGE9WBFn",

},

"Success":true,

}

Created Invoice Cancellation

The method to create invoice cancellation.

Method URL:

https://api.cloudpayments.ru/orders/cancel

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Id | String | Required | Invoice ID |

The system returns a message about the successful operation in response to correctly created request.

Request example:

{"Id":"f2K8LV6reGE9WBFn"}

Response example:

{"Success":true,"Message":null}

View of Notification Settings

The method to view notification settings (with selection of notification type).

Method URL:

https://api.cloudpayments.ru/site/notifications/{Type}/get

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Type | String | Required | Notification type: Check/Pay/Fail and so on (see the reference) |

Response example on Pay notification:

https://api.cloudpayments.ru/site/notifications/pay/get

{

"Model": {

"IsEnabled": true,

"Address": "http://example.com",

"HttpMethod": "GET",

"Encoding": "UTF8",

"Format": "CloudPayments"

},

"Success": true,

"Message": null

}

Change of Notification Settings

The method to change notification settings.

Method URL:

https://api.cloudpayments.ru/site/notifications/{Type}/update

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| Type | String | Required | Notification type: Pay, Fail and so on except Check (see the reference) |

| IsEnabled | Bool | Optional | True is enabled, Default is false. |

| Address | String | Optional if IsEnabled=false, else Required |

Address for sending notifications (for HTTPS schemes a valid SSL certificate is required). |

| HttpMethod | String | Optional | HTTP method for sending notifications. Possible values: GET, POST. The default is GET. |

| Encoding | String | Optional | Encoding of notifications. Possible values: UTF8, Windows1251. The default is UTF8. |

| Format | String | Optional | The format of the notifications. Possible values: CloudPayments, QIWI, RT. The default is CloudPayments. |

Example request for Pay notification:

https://api.cloudpayments.ru/site/notifications/pay/update:

{

"IsEnabled": true,

"Address": "http://example.com",

"HttpMethod": "GET",

"Encoding": "UTF8",

"Format": "CloudPayments"

}

Response example:

{"Success":true,"Message":null}

Start of Apple Pay Session

Start of session is required to take payments via Apple Pay in Web. It is not required for Mobile platforms.

Method URL:

https://api.cloudpayments.ru/applepay/startsession

Parameters:

| Parameter | Type | Use | Description |

|---|---|---|---|

| ValidationUrl | String | Required | Address received in Apple JS |

| paymentUrl | String | Optional | Address for starting a session in Apple |

The system returns a session in the Model object for paying via Apple Pay in JSON response to correctly created request.

Request example:

{"ValidationUrl":"https://apple-pay-gateway.apple.com/paymentservices/startSession"}

Response example:

{

"Model": {

"epochTimestamp": 1545111111153,

"expiresAt": 1545111111153,

"merchantSessionIdentifier": "SSH6FE83F9B853E00F7BD17260001DCF910_0001B0D00068F71D5887F2726CFD997A28E0ED57ABDACDA64934730A24A31583",

"nonce": "d6358e06",

"merchantIdentifier": "41B8000198128F7CC4295E03092BE5E287738FD77EC3238789846AC8EF73FCD8",

"domainName": "demo.cloudpayments.ru",

"displayName": "demo.cloudpayments.ru",